Cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit. In 2025, digital assets continue to evolve, offering groundbreaking investment opportunities. These decentralized financial tools are typically based on blockchain technology, which is a distributed ledger enforced by a disparate network of computers.

Some of the most well-known cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA). These projects offer various utilities, from smart contracts to decentralized applications, and their value has increased as adoption has spread globally.

Why Invest in Cryptocurrency in 2025?

The digital finance space in 2025 is more mature and regulated than in the early years. Cryptocurrencies now serve as:

-

Hedges against inflation

-

Access points to decentralized finance (DeFi)

-

Opportunities for high ROI

-

Components of diversified investment portfolios

With institutional adoption on the rise and clearer regulatory frameworks, it’s an ideal time for beginners to start investing in cryptocurrencies.

Step-by-Step Guide to Start Investing in Cryptocurrency in 2025

1. Choose a Reliable Cryptocurrency Exchange

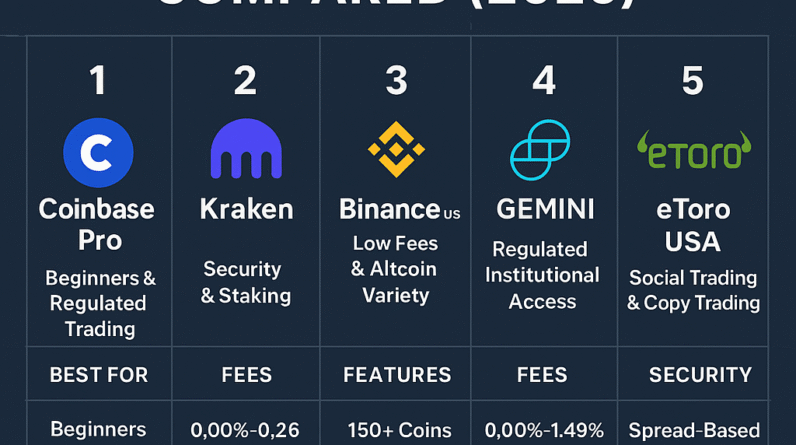

To begin your crypto journey, you must select a trusted and secure exchange. In 2025, the most reputable platforms include:

-

Binance

-

Coinbase

-

Kraken

-

Gemini

-

eToro

Key features to look for in an exchange:

-

Regulatory compliance

-

Two-factor authentication

-

Insurance on stored assets

-

User-friendly interface

-

Low transaction fees

Create an account, complete KYC (Know Your Customer) verification, and link your payment method (bank account, credit card, or PayPal).

2. Secure Your Investments with a Wallet

While exchanges offer convenience, storing your crypto on an exchange is risky. Opt for personal wallets to ensure better security:

-

Hot Wallets (online): MetaMask, Trust Wallet, Exodus

-

Cold Wallets (offline): Ledger Nano X, Trezor Model T

Cold storage wallets offer the best protection from hacking, making them ideal for long-term holders.

3. Select the Right Cryptocurrencies

As a beginner, you should start by investing in blue-chip cryptocurrencies:

-

Bitcoin (BTC): The most established digital asset

-

Ethereum (ETH): Backbone of the DeFi and NFT ecosystem

-

Solana (SOL): Known for its high-speed transactions and low fees

-

Polygon (MATIC): Layer 2 scaling solution for Ethereum

Diversification is crucial—avoid putting all your capital into a single coin.

4. Determine Your Investment Strategy

Your strategy depends on your risk tolerance, investment goals, and market understanding. In 2025, these are the most popular strategies:

-

Buy and Hold (HODL): Ideal for long-term investors

-

Dollar-Cost Averaging (DCA): Invest fixed amounts at regular intervals

-

Swing Trading: Capture short-to-medium-term gains by following price trends

-

Staking and Yield Farming: Earn passive income by participating in network security or liquidity provision

5. Understand and Manage Risk

Cryptocurrency markets are highly volatile. Key principles of risk management include:

-

Never invest more than you can afford to lose

-

Set stop-loss limits

-

Avoid FOMO (Fear of Missing Out)

-

Do your own research (DYOR) before investing in any coin

Risk is a part of every investment, but with the right strategies, it can be minimized effectively.

6. Keep Track of Your Portfolio

Use portfolio management tools like:

-

CoinMarketCap

-

CoinGecko

-

Blockfolio

-

Delta

These tools allow you to track prices, monitor trends, and evaluate performance over time. In 2025, many also offer AI-powered predictions and alerts, helping beginners make informed decisions.

Common Mistakes to Avoid as a Beginner

Avoid these beginner pitfalls:

-

Investing blindly in hype-driven coins

-

Ignoring wallet security

-

Chasing quick profits

-

Failing to diversify

-

Not understanding tax implications

In many jurisdictions, crypto gains are taxable, so maintain clear records and consult a tax professional.

Best Practices for Crypto Investing in 2025

To succeed, follow these battle-tested principles:

-

Start small and scale gradually

-

Use trusted news sources like CoinDesk, CryptoSlate, and The Block

-

Join crypto communities on Reddit, Discord, and Twitter

-

Stay updated on regulations in your country

-

Invest time in learning, not just earning

Education is the key—the more you understand blockchain technology, the better your investment decisions.

Advanced Investment Opportunities

Once you’re comfortable, consider exploring:

-

NFTs (Non-Fungible Tokens): Digital ownership of unique assets

-

DeFi protocols: Platforms like Aave, Compound, and Uniswap

-

Initial DEX Offerings (IDOs): Early-stage investments on decentralized exchanges

-

Web3 Projects: Decentralized applications (dApps) and Metaverse integrations

These offer high returns but come with higher risk—only invest after thorough research.

Staying Safe in the Crypto World

Security is everything in crypto. Here are some tips to protect your assets:

-

Enable 2FA on all accounts

-

Use strong, unique passwords

-

Avoid phishing emails and fake websites

-

Backup your wallet’s seed phrase offline

-

Be skeptical of unsolicited investment offers

Scams are rampant in the crypto space. A cautious and educated approach is your best defense.

Conclusion: Take the First Step with Confidence

Starting your cryptocurrency investment journey in 2025 is not only feasible but smarter than ever before. With better tools, more educational resources, and a mature regulatory landscape, beginners can enter the space with confidence.

The key is to educate yourself, invest responsibly, and focus on long-term growth. Whether you’re looking to hedge against inflation, earn passive income, or simply explore the future of finance, cryptocurrency offers a powerful platform for financial empowerment.