As we approach the mid-2020s, Bitcoin’s trajectory in 2025 is under intense scrutiny by investors, regulators, and blockchain enthusiasts alike. Once viewed solely as a speculative asset, Bitcoin has matured into a major financial instrument, impacting not only the crypto industry but also traditional markets, governments, and global economies.

Global Adoption: Bitcoin as a Mainstream Asset Class

In 2025, Bitcoin adoption is no longer a fringe concept. Large-scale institutional involvement—from hedge funds to sovereign wealth funds—has significantly increased Bitcoin’s legitimacy and stability.

-

Governments and Central Banks: Some countries now list Bitcoin as part of their sovereign reserves, recognizing it as a hedge against inflation and currency devaluation.

-

Retail Penetration: With user-friendly platforms and mobile wallets, millions of individuals across Africa, Asia, and Latin America use Bitcoin for remittances, daily transactions, and savings.

-

Enterprise Integration: Tech giants and global corporations continue integrating Bitcoin into their payment systems and treasury strategies.

Bitcoin Price Predictions for 2025

The most discussed question: How much will Bitcoin be worth in 2025?

Analysts project a range of outcomes depending on macroeconomic trends and regulatory clarity. Here are a few scenarios:

-

Bullish Case: With widespread adoption and limited supply, Bitcoin could surpass $200,000 by Q4 2025.

-

Moderate Growth: Assuming steady institutional investment and stable global markets, Bitcoin might hover between $100,000 and $150,000.

-

Bearish Outlook: In the face of severe regulation or black swan events, prices could drop below $50,000, although this is considered less likely.

Bitcoin Regulations in 2025: Tighter Frameworks, Greater Legitimacy

The regulatory landscape for Bitcoin is undergoing a transformation:

-

Clear Taxation Rules: Countries like the U.S., UK, and India have introduced specific tax codes for Bitcoin transactions, mining income, and capital gains.

-

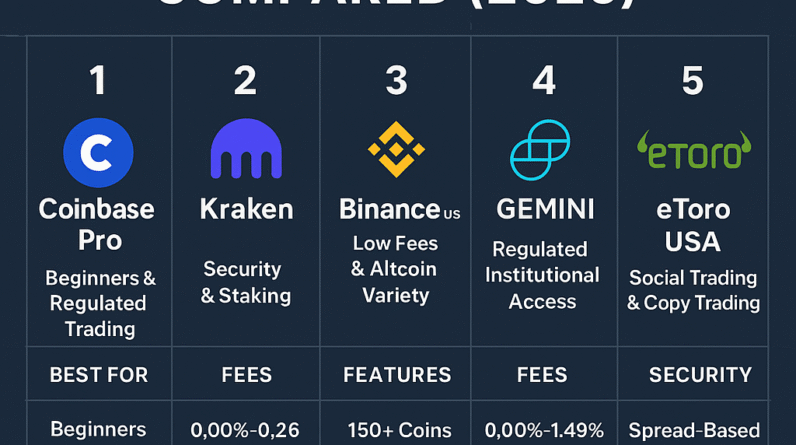

KYC/AML Enforcement: Exchanges and DeFi platforms must now comply with global Know Your Customer (KYC) and Anti-Money Laundering (AML) standards.

-

CBDCs and Bitcoin: With Central Bank Digital Currencies gaining ground, Bitcoin stands as a decentralized alternative, leading to both competition and symbiosis.

These frameworks are making Bitcoin more transparent and trusted, particularly by institutional players who require regulatory certainty.

Mining and the Bitcoin Halving Impact

The 2024 Bitcoin halving—which cut block rewards from 6.25 BTC to 3.125 BTC—has had significant implications in 2025:

-

Decreased New Supply: With fewer coins entering circulation, scarcity is increasing.

-

Mining Consolidation: Only the most energy-efficient mining operations, often powered by renewable energy, remain profitable.

-

Hash Rate Growth: Despite halving, the network’s security is stronger than ever, with a hash rate exceeding 500 EH/s.

This technical environment creates a bullish supply-demand dynamic pushing prices upward.

Institutional Involvement in 2025

In 2025, institutional finance and Bitcoin are more interconnected than ever:

-

Bitcoin ETFs and Mutual Funds: Widely accepted and traded on NASDAQ, NYSE, and London Stock Exchange.

-

Banking Sector Integration: Major banks offer Bitcoin custodial services, loans backed by BTC collateral, and crypto debit cards.

-

Corporate Treasuries: Companies like MicroStrategy, Tesla, and newer players hold billions in BTC as a treasury reserve asset.

Institutional adoption helps stabilize volatility and reinforce Bitcoin’s status as digital gold.

Decentralization and Network Evolution

Despite rising institutional influence, Bitcoin’s decentralized ethos remains intact:

-

Node Growth: There are now more than 100,000 active Bitcoin full nodes globally.

-

Lightning Network Expansion: Layer-2 solutions such as the Lightning Network have dramatically improved transaction speed and scalability.

-

Privacy Enhancements: Tools like CoinJoin and Taproot ensure improved anonymity without compromising compliance.

Bitcoin’s infrastructure continues to evolve, making it not only a store of value but also a viable medium of exchange.

Environmental Sustainability and Green Bitcoin

Energy consumption has long been a concern. In 2025, the industry has made major strides toward sustainability:

-

Shift to Renewable Energy: Over 60% of Bitcoin mining now utilizes wind, hydro, and solar energy.

-

Carbon Credits and Offsets: Miners purchase carbon offsets and support reforestation to neutralize emissions.

-

Green Mining Standards: Mining pools now operate under global ESG (Environmental, Social, Governance) guidelines.

This shift makes Bitcoin more acceptable to ESG-conscious investors and regulators.

Bitcoin and Geopolitics

Bitcoin plays a significant role in international finance and geopolitics in 2025:

-

Sanctioned Countries: Nations under financial embargoes use Bitcoin to access global trade and liquidity.

-

Remittance Revolution: Cross-border transfers are now faster and cheaper using Bitcoin, especially in countries with unstable currencies.

-

Financial Sovereignty: Citizens in autocratic regimes increasingly rely on Bitcoin to preserve wealth and privacy.

Bitcoin is not just an asset—it’s a tool for financial freedom and political empowerment.

Challenges and Risks Ahead

Despite its growth, Bitcoin still faces challenges:

-

Scalability Limits: Even with Lightning Network, global transaction volume remains a hurdle.

-

Quantum Computing Threats: Theoretical concerns over cryptographic vulnerabilities persist, though quantum-resistant upgrades are under research.

-

Market Manipulation: Whales and leveraged trading can still cause short-term price volatility.

-

Fake Wallets and Scams: Despite better security, phishing attacks and fraud continue to affect users.

Addressing these risks will determine Bitcoin’s long-term sustainability.

Conclusion:

In 2025, Bitcoin is no longer just a speculative asset. It has evolved into a powerful, decentralized, and global store of value—embraced by institutions, protected by regulation, powered by green energy, and woven into the economic fabric of the modern world. Whether you’re an investor, developer, or policymaker, the next phase of Bitcoin’s journey is not only exciting but pivotal to the future of finance.