As the cryptocurrency industry matures, staking has become one of the most attractive ways for investors to earn passive income. In 2025, with proof-of-stake (PoS) dominating the blockchain landscape, selecting the best crypto staking platforms is essential for maximizing returns, maintaining security, and accessing a wide range of staking assets. In this comprehensive guide, we explore the top staking platforms in 2025, ranked by reliability, APY rates, supported assets, security, and user experience.

What Is Crypto Staking?

Staking is the process of locking up a specific amount of cryptocurrency to support a blockchain network’s operations, such as transaction validation and governance. In return, participants receive staking rewards, often in the form of additional tokens. It’s a key feature of proof-of-stake and its variants like delegated PoS and liquid staking.

Top 10 Crypto Staking Platforms in 2025

Below are the best staking platforms for 2025, thoroughly researched and verified based on key performance indicators and user trust.

1. Binance Earn – Best Overall Staking Platform

Binance continues to dominate as the leading crypto exchange and staking provider in 2025.

-

Supported Coins: 100+ including ETH, BNB, ADA, DOT, and SOL

-

Staking APY: Up to 25% depending on asset and lock period

-

Features:

-

Flexible and locked staking

-

DeFi staking options

-

Auto-compounding available

-

-

Security: Industry-leading with SAFU insurance fund

-

Why We Recommend: Highest liquidity, trusted by millions, extensive token support

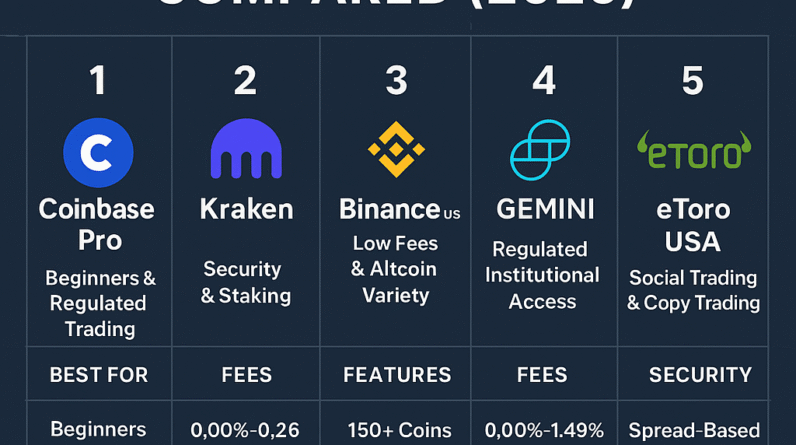

2. Kraken – Best for Security and Compliance

Kraken offers one of the most secure and regulatory-compliant staking services on the market.

-

Supported Coins: ETH, ADA, DOT, ATOM, FLOW, and more

-

Staking APY: 4%–21% depending on the token

-

Features:

-

On-chain and off-chain staking

-

No minimum staking amount

-

Scheduled reward payouts

-

-

Security: SOC 2 Type I certified, world-class custody systems

-

Why We Recommend: Ideal for institutional and security-conscious investors

3. Coinbase – Best for Beginners

Coinbase, a publicly traded platform, offers a beginner-friendly interface with simple staking solutions.

-

Supported Coins: ETH, SOL, ADA, ATOM, and more

-

Staking APY: Typically 3%–6%

-

Features:

-

Automatic staking with ETH2

-

Clear tax reporting tools

-

Regulatory compliance in the U.S.

-

-

Security: FDIC-insured USD balances, strong cybersecurity

-

Why We Recommend: Transparent, easy to use, and trusted in North America

4. Lido Finance – Best for ETH Liquid Staking

Lido has led the liquid staking revolution, especially for Ethereum.

-

Supported Coins: ETH, SOL, MATIC, DOT

-

Staking APY: ~4%–7%

-

Features:

-

Liquid staking with stETH and similar tokens

-

Full DeFi integration

-

DAO-governed system

-

-

Security: Audited smart contracts and community governance

-

Why We Recommend: Unlocks liquidity while earning rewards

5. Rocket Pool – Decentralized ETH Staking

Rocket Pool offers a decentralized alternative to Lido for Ethereum staking.

-

Supported Coins: ETH only

-

Staking APY: ~4% with rETH

-

Features:

-

Anyone can run a node with just 16 ETH

-

Non-custodial liquid staking

-

Fully decentralized network

-

-

Security: Audited contracts and decentralized design

-

Why We Recommend: Supports Ethereum decentralization and provides flexibility

6. KuCoin Earn – High APY Opportunities

KuCoin is known for offering high-yield staking opportunities, particularly in emerging altcoins.

-

Supported Coins: Over 60, including popular DeFi and NFT tokens

-

Staking APY: 3%–30%

-

Features:

-

Soft staking (no lock-up)

-

Dual investment and DeFi staking

-

Promotion-based staking boosts

-

-

Security: Multi-layer security architecture and proof-of-reserve policy

-

Why We Recommend: Excellent for active users chasing high yields

7. OKX Earn – Best for Advanced DeFi Users

OKX blends centralized and decentralized finance features in its staking suite.

-

Supported Coins: 70+ PoS tokens

-

Staking APY: 5%–20%

-

Features:

-

Dual staking and DeFi staking

-

Earn through vaults, liquidity farming, and fixed terms

-

Mobile and desktop app

-

-

Security: ISO-certified systems, advanced authentication

-

Why We Recommend: Ideal for DeFi enthusiasts with yield farming knowledge

8. Bybit Earn – Flexible Staking Solutions

Bybit has grown into a robust platform offering flexible and locked staking choices.

-

Supported Coins: ETH, USDT, DOT, and 30+ others

-

Staking APY: Up to 18%

-

Features:

-

Earn with dual asset and structured products

-

Fast reward withdrawals

-

Active promotions for new users

-

-

Security: Cold wallet storage, 2FA, and insurance fund

-

Why We Recommend: Great for short-term and flexible staking opportunities

9. Nexo – Staking Plus Interest Earnings

Nexo offers staking through its Earn Interest product with added financial tools.

-

Supported Coins: BTC, ETH, MATIC, USDT, USDC

-

Staking APY: Up to 16%

-

Features:

-

Daily compounding interest

-

Instant credit lines based on crypto holdings

-

Integrated wallet and card services

-

-

Security: Insured custody up to $775M

-

Why We Recommend: Combines staking with high-yield interest savings

10. Trust Wallet – Best for Mobile Staking

Trust Wallet, a non-custodial mobile wallet, offers seamless staking from your smartphone.

-

Supported Coins: BNB, TRX, ATOM, SOL, KAVA

-

Staking APY: Up to 11%

-

Features:

-

In-app staking dashboard

-

You control your private keys

-

No sign-up or KYC required

-

-

Security: Local device encryption, biometric login

-

Why We Recommend: Ultimate control and convenience for mobile users

What to Look for in a Crypto Staking Platform

Before selecting a staking provider, always evaluate these essential factors:

-

APY rates: Compare yields across tokens and platforms

-

Security: Prefer insured, audited, and well-established platforms

-

Asset support: Ensure the platform supports the tokens you hold

-

Lock-up periods: Know how long your assets will be inaccessible

-

Reputation: Trust platforms with strong community and user reviews

-

Ease of use: Choose interfaces that match your experience level

Frequently Asked Questions

Is Crypto Staking Safe in 2025?

Yes, staking is generally safe, especially with regulated and reputable platforms like Binance, Kraken, and Coinbase. However, always assess platform risk, smart contract vulnerabilities, and market volatility.

What Is Liquid Staking?

Liquid staking allows you to receive a tokenized version of your staked asset (e.g., stETH for ETH), which can be traded or used in DeFi protocols.

Which Coins Are Best for Staking in 2025?

Top staking coins include Ethereum (ETH), Solana (SOL), Cardano (ADA), Cosmos (ATOM), and Polkadot (DOT) due to their strong networks and consistent rewards.

Final Thoughts

In 2025, staking is no longer an edge feature — it’s a core function of participating in blockchain networks. The platforms listed above represent the best crypto staking platforms in terms of rewards, trust, security, and usability. Whether you’re a beginner or an experienced DeFi user, there’s a staking platform that fits your needs and helps grow your crypto portfolio.