In today’s fast-evolving digital world, Artificial Intelligence (AI) and Cryptocurrency stand at the forefront of innovation. Each of these technologies alone has disrupted industries and created massive wealth. But together, their fusion has sparked a new wave of opportunities. Investors are no longer asking if they should invest in AI or crypto — they’re asking how to capitalize on the combined force of AI + Crypto. This new hybrid market promises not only enhanced security and efficiency but also unprecedented value creation.

Why AI and Crypto Are a Perfect Match

1. Enhanced Trading Through AI-Powered Algorithms

One of the most immediate applications of AI in crypto is automated trading. AI algorithms can process vast datasets in real time, detect market trends, and execute trades with unmatched precision. These AI trading bots reduce human error, respond instantly to market volatility, and can deliver significantly higher ROI compared to traditional strategies.

Many institutional investors are leveraging machine learning (ML) models to analyze historical price data, social sentiment, and blockchain activity. These insights empower them to anticipate price movements and make data-backed decisions.

2. Fraud Detection and Security Enhancements

The decentralized nature of cryptocurrency often attracts malicious actors. Here, AI steps in as a powerful security layer. Using pattern recognition and anomaly detection, AI can identify suspicious activity on the blockchain — such as irregular transaction volumes or unusual wallet behavior.

AI helps blockchain networks maintain integrity by recognizing and neutralizing phishing attacks, wallet hacks, and malware-based threats before damage is done.

3. Intelligent Blockchain Automation

AI’s ability to automate smart contracts is revolutionizing how businesses operate on decentralized networks. For instance, smart contracts integrated with AI can self-optimize by learning from historical performance. This innovation paves the way for more dynamic DeFi (Decentralized Finance) applications that adapt in real time to user behavior or market conditions.

AI Tokens: The New Face of Investment

AI-focused crypto projects are emerging as a new investment category. These AI tokens fuel ecosystems that blend artificial intelligence capabilities with blockchain infrastructure.

Some noteworthy AI-powered cryptocurrencies include:

-

Fetch.ai (FET): An open-access decentralized machine learning network that enables smart infrastructure.

-

Numerai (NMR): A hedge fund governed by AI and data scientists around the globe.

-

SingularityNET (AGIX): A decentralized platform that allows AI services to interact and trade value.

These tokens are not just speculative assets; they power functional ecosystems, solve real-world problems, and generate long-term value.

Top Sectors Revolutionized by AI + Crypto

1. Healthcare

With AI + blockchain, we can secure and analyze medical records faster and with more accuracy. Patients gain control over their data while researchers access anonymized datasets for breakthroughs.

2. Supply Chain Management

Blockchain provides transparency; AI delivers optimization. Together, they allow real-time tracking, predictive logistics, and fraud prevention in global supply chains.

3. Finance and Banking

Traditional banking is being disrupted by AI-driven DeFi protocols. These systems offer faster credit assessments, automatic loan disbursements, and improved risk management — all with minimal human intervention.

4. NFTs and Digital Art

AI is enabling the creation of generative art NFTs, while blockchain ensures provenance and ownership. This new art form has created multi-million-dollar markets where creativity meets code.

Risks and Challenges of Investing in AI + Crypto

Despite its promise, this sector isn’t without risks:

-

Regulatory Uncertainty: Governments are still grappling with how to regulate these emerging technologies. Changes in legislation can significantly affect project viability.

-

Technology Maturity: While AI and crypto are individually mature, their integration is still evolving.

-

Market Volatility: Crypto markets are notoriously volatile, and AI models can only mitigate — not eliminate — risk.

That said, for those with a strong risk appetite, the rewards can be considerable.

How to Invest in the AI + Crypto Ecosystem

1. Direct Token Purchase

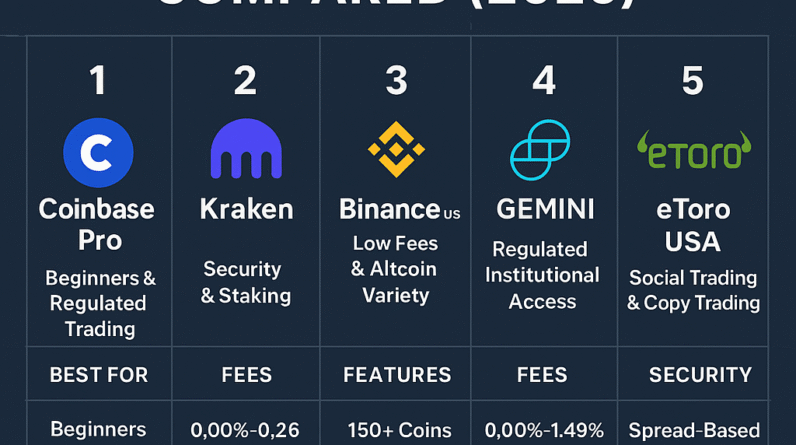

Invest in leading AI tokens through reputable crypto exchanges like Binance, Coinbase, or Kraken. Look for projects with:

-

Strong development teams

-

Transparent roadmaps

-

Real-world use cases

-

Active community support

2. Venture Capital and Startups

For accredited investors, participating in AI + Crypto startups via initial coin offerings (ICOs) or equity crowdfunding can offer early exposure to future unicorns.

3. AI-Based Crypto Funds

Some hedge funds and asset managers are now offering AI-managed crypto portfolios. These funds use proprietary AI algorithms to trade crypto assets automatically, offering passive income potential.

Future Outlook: What Lies Ahead

The intersection of AI and crypto marks the beginning of a new era in digital investment. We foresee:

-

AI-powered DAOs (Decentralized Autonomous Organizations): Governance without human intervention.

-

Hyper-personalized DeFi platforms: Financial tools tailored in real time by AI.

-

Decentralized AI marketplaces: A global economy where AI models can be bought, sold, or leased securely via blockchain.

As both sectors continue to scale, we expect AI + Crypto to become a central pillar of global innovation and investment.

Final Thoughts

The fusion of AI and cryptocurrency represents a bold frontier — where the analytical power of artificial intelligence meets the transparency and decentralization of blockchain. As this ecosystem matures, it promises to reshape entire industries, redefine digital ownership, and create transformative investment opportunities.

For forward-thinking investors, early adoption in AI + Crypto could deliver exponential gains. However, it demands diligence, risk management, and a deep understanding of both domains. Those who move intelligently now may become the pioneers of a new digital wealth revolution.